As the world is growing at a faster pace, so is the transactions in the business especially in an e-commerce business. Its become really hard to manage things.

In order to manage the transactions and the taxes, many software solutions have jumped into the market.

One of the major is Avalara, advanced software tax management system that provides simplified solutions for automated tax calculations for e-commerce businesses which include sales and use, VAT, excise, communications, and others.

With managing tax over leading continents (over 40 countries in all). With such a large reach and increase in the demand. The need for tax management on various websites have become essential.

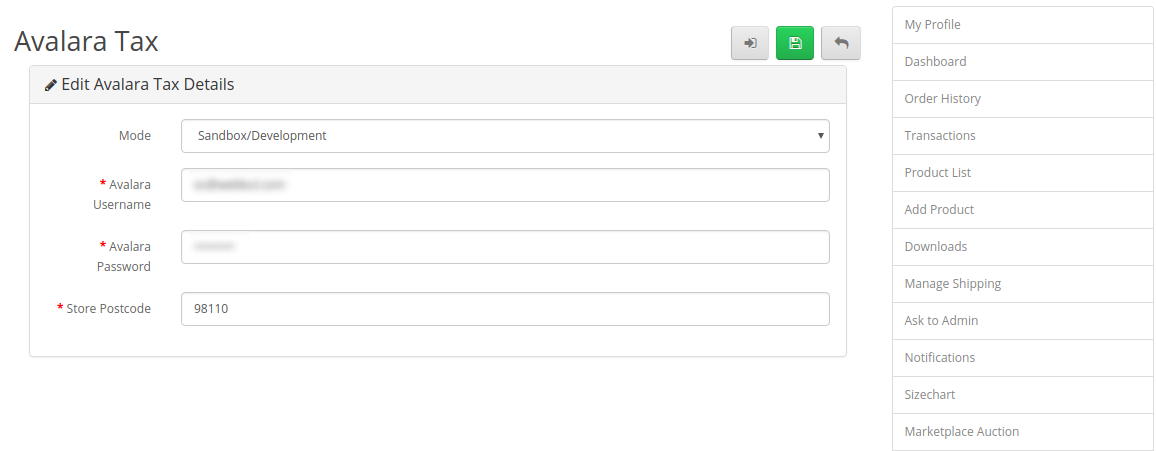

With the Opencart Multi Vendor Avalara , you can incorporate Avalara’s services to e-commerce website like Opencart. This will help the store owner and the seller to configure taxes for the products.

Various Tax Class and Tax Rates can be edited by the store owner and the various seller for their various products

Why Avalara is needed for your Marketplace?

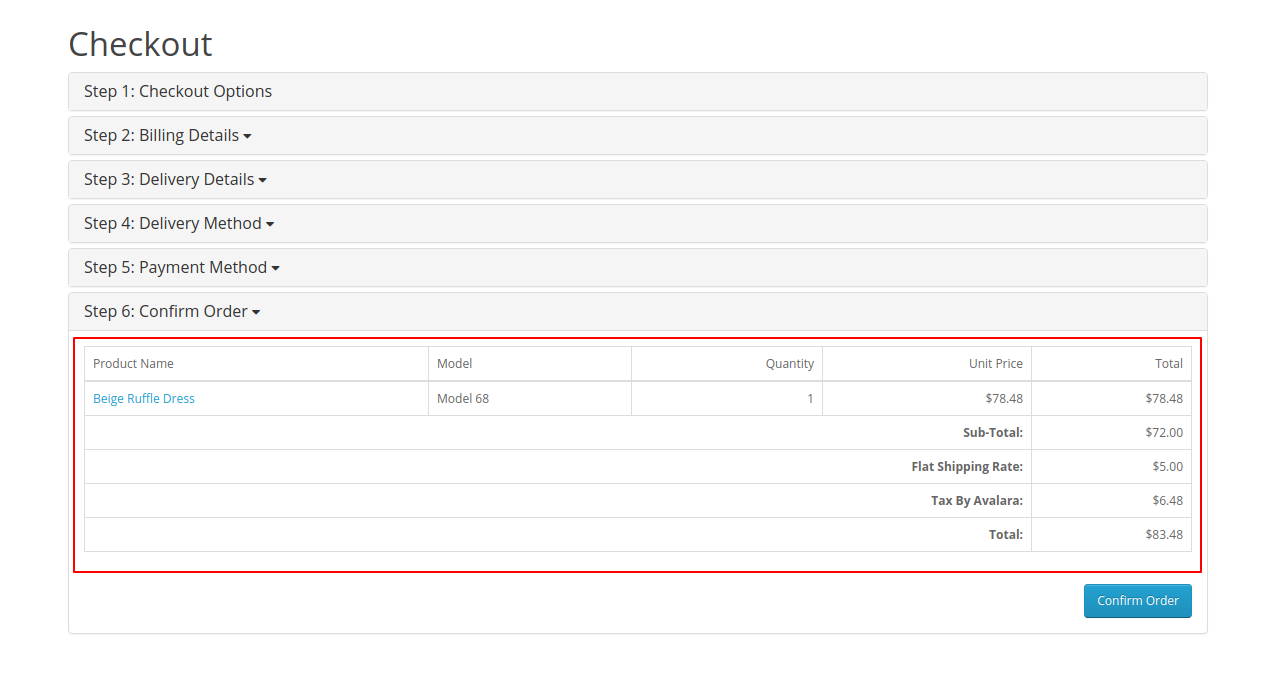

Real-Time Tax Updates (During Checkout)

In a Marketplace, where there are multiple sellers. It becomes difficult to manage taxes of all the placed orders . Let us take an example, suppose there are 3 sellers with different products purchase from each seller.

– Seller A ( location A ) – Product P1 purchased by customer A (Location X)

– Seller B ( location B ) – Product P2 purchased by customer B (Location Y)

– Seller C ( location C ) – Product P3 purchased by customer C (Location Z)

So what is the problem?

It becomes very difficult to manage the tax for each customer based on the shipping address and the seller’s location for this our module comes into play and manages the tax in Real-time at the time of checkout.

Individual Tax Account For Each Seller

As we know the product purchased in the marketplace are not always the same. They may vary from Pen to a Sofa set. So it is difficult to set the tax rates for each product.

But with the separate seller accounts, this can be managed easily as the respective company and tax collection rates will be different for each seller which can be fetched easily through the API without any issue.

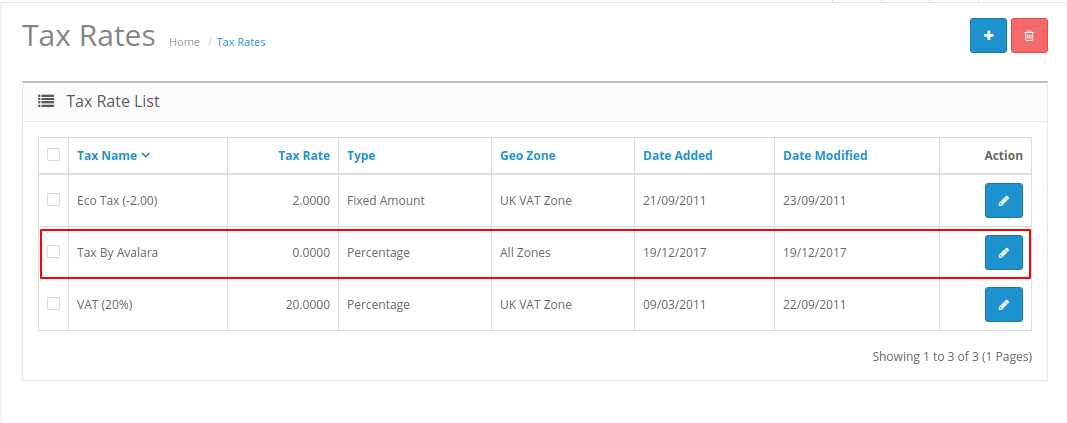

Customizable Tax Rate and Class

With the ease of custom tax class and tax rate creation. It would be easier for the store owner to manage the taxes for different orders.

Let us take an example:

For instance, you have ordered a product P1 from seller A when you were in location A. The tax rates will be calculated accordingly.

But if the same product P1 is ordered from location B then different taxes will be assigned based on the Zones and the respective Pin Codes.

The store owner can add their custom Tax Class and Tax Rates based on which the taxes get calculated.

Step Up Your Game

If you have started the business on a small scale with minimal distribution range and want to scale up your website with distribution range to go across countries and continents then it will be highly recommended to use this module.

Majority of the sellers are not aware of the tax management and correct tax calculation when it comes to selling products across countries. The hiring of resource to tackle these issues will be havoc.

So, you can use our module, as it will save the time and money lost in calculating the taxes.

If you still have any issue feel free to add a ticket and let us know your views at http://webkul.uvdesk.com/